Need Help

If you need help setting up services or accessing your accounts, please call our Customer Care Team at 866.552.9172 during business hours (7 a.m. — 5 p.m. PST, M-F) or email us at CustomerCare@AgWestFC.com.

Location

If you need help setting up services or accessing your accounts, please call our Customer Care Team at 866.552.9172 during business hours (7 a.m. — 5 p.m. PST, M-F) or email us at CustomerCare@AgWestFC.com.

Location

If you need help setting up services or accessing your accounts, please call our Customer Care Team at 866.552.9172 during business hours (7 a.m. — 5 p.m. PST, M-F) or email us at CustomerCare@AgWestFC.com.

Securely update and exchange balance sheet information with your AgWest team.

Put your idle cash to work with a suite of banking services that sweeps funds between accounts. Fees apply.

AgWest Farm Credit’s 12-month outlook sees wineries as slightly profitable and vineyards as breakeven.

Drivers include excess wine supply in Washington and removal of uncontracted acres, winter damage in some growing areas, mixed Direct-to-Consumer sales, a large crop in California and declining imports.

12-Month Profitability Outlook

Wine grape acres decline in Washington

Some producers with uncontracted production are removing acres in response to an oversupplied market, particularly with cabernet sauvignon. Some growers may replant with varieties that are better aligned with consumer demand, including sauvignon blanc and chardonnay. It can take three to six years for new varietals to come to market, and the long-term impact on prices is not clear.

Cold weather damages vineyards

Cold weather in January damaged some vineyards in Walla Walla, northern Washington and British Columbia; however, the extent is not yet known. Damaged acres could reduce wine grape production in 2024.

Excess wine supply in Washington

While the removal/replanting of vineyard acres and damage from recent weather events could reduce yields and improve the supply and demand balance, Washington is likely to remain oversupplied over the next couple of years. Excess inventories with multiple vintage years remain a challenge.

California’s 2023 crop size increases

California’s 2023 wine grape crop increased 8% from 2022, in part due to production gains in the North Coast, Central Coast and northern interior regions; however, a significant number of tons were not harvested due to weak demand and quality issues. As in Washington, California faces an oversupplied market.

Direct-to-Consumer (DtC) sales mixed

DtC sales values in 2023 were relatively flat across the West Coast; however, declines occurred in terms of volume in both California and Oregon. National DtC sales are increasing in the $60+/bottle categories and falling in lower-priced tiers.

Imports decline in 2023

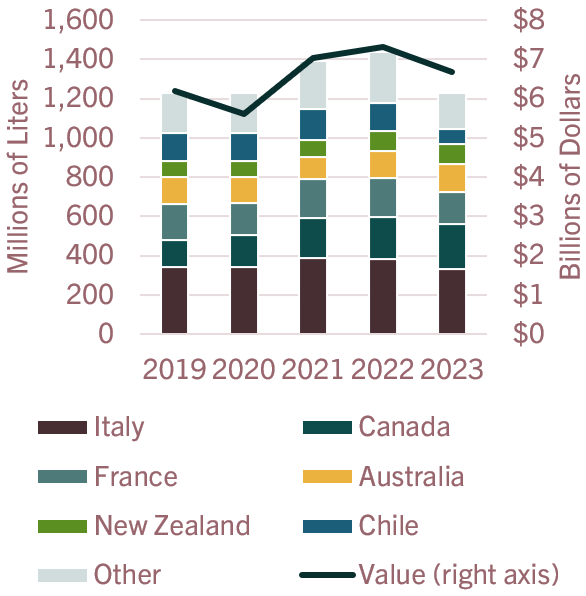

Wine imports declined from nearly every major trade partner, particularly Chile (down 45% year over year), France (16%) and Italy (13%). While total value declined as well, per-bottle values increased by 7% on average. Reduced import volumes and increased per-bottle values could support domestic prices.

Wine imports by country

Source: U.S. Census Bureau.

As a whole, wineries should be slightly profitable, and vineyards breakeven over the next year. Both Washington and California are likely to remain oversupplied for multiple years. Some producers with uncontracted production in Washington are removing acres and some vineyards experienced damage over the winter. Direct-to-Consumer sales are mixed, with Oregon and California experiencing declines in sales volumes. Falling import volumes and rising per-bottle values may provide some support to domestic prices.

For more information or to share your thoughts and opinions, contact the Business Management Center at 866.552.9193 or bmc@AgWestFC.com.

To receive email notifications about western and global agricultural and economic perspectives, trends, programs, events, webinars and articles, visit www.AgWestFC.com/subscribe or contact the Business Management Center.

View the latest AgWest Wine/Vineyard Industry Perspective

Learn more.jpg?sfvrsn=ba5fe18_1)

AgWest supports customers with a wide range of industry and business management resources

Learn more