Need Help

If you need help setting up services or accessing your accounts, please call our Customer Care Team at 866.552.9172 during business hours (7 a.m. — 5 p.m. PST, M-F) or email us at CustomerCare@AgWestFC.com.

Location

If you need help setting up services or accessing your accounts, please call our Customer Care Team at 866.552.9172 during business hours (7 a.m. — 5 p.m. PST, M-F) or email us at CustomerCare@AgWestFC.com.

Location

If you need help setting up services or accessing your accounts, please call our Customer Care Team at 866.552.9172 during business hours (7 a.m. — 5 p.m. PST, M-F) or email us at CustomerCare@AgWestFC.com.

Securely update and exchange balance sheet information with your AgWest team.

Put your idle cash to work with a suite of banking services that sweeps funds between accounts. Fees apply.

AgWest Farm Credit’s 12-month outlook sees apple growers as generally unprofitable and packers as profitable for the 2023 crop.

12-Month Profitability Outlook

Low prices impact producer profitability

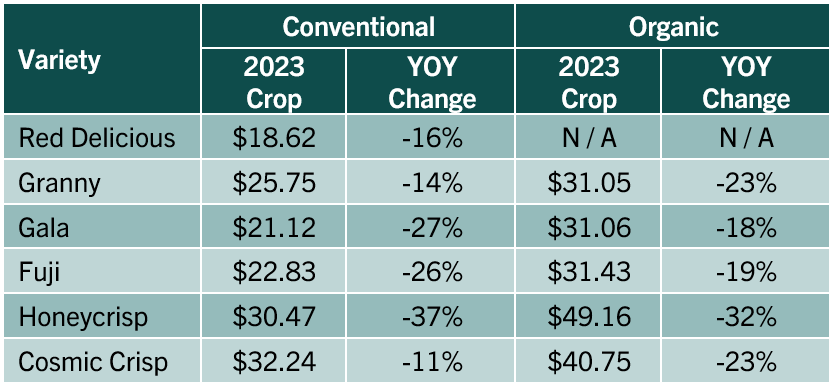

Apple prices remain subdued due to the large 2023 crop, which is impacting producer profitability. Producers who sold fruit early in the season benefited from better prices.

Season-to-date prices

Source: WSTFA March 13, Weekly Summary Bulletin Report. N/A: Not Available. YOY: Year-over-year.

Inventory movement excellent

Lower pricing has stimulated domestic and international sales, and product movement to retailers is currently strong (see chart below). If this continues, the overlap between marketing of the 2023 crop and 2024 crop should be lessened and would benefit early spring pricing for the 2024 crop.

Season-to-date Exports by Country, as of December

Source: WSTFA Shipment Report 28.

Strong season-to-date shipments suggest strong demand.

Shipping costs rise

Apple exports are surging; however, low water levels on the Panama Canal, escalating conflict on the Red Sea and rising energy prices are impacting global shipping costs and could lower export volumes. See our Crop Inputs Snapshot for more information.

Whole Revenue Farm Protection (WRFP) insurance reliance increases

WRFP claims on the 2023 crop are multiples higher than last season; however, several consecutive years of below-average returns are limiting paid benefits, which are calculated based on historic average returns. Looking forward, some growers are increasing coverage levels on the 2024 crop as another unprofitable year could greatly impact their businesses.

Industry hopeful for a smaller 2024 crop

Early indications suggest the 2024 crop will be better aligned with demand while also supporting packer profitability due to alternate bearing (crop sizes alternate between larger and smaller each year). Reduced apple supply should be supportive of higher prices.

Most producers will recognize a loss on the 2023 crop, while most packers will profit from packing the large 2023 crop; however, those packing profits will primarily be generated in the 2024 calendar year. Reliance on Whole Revenue Farm Protection is increasing as a risk management tool. The industry expects the 2024 crop to be smaller and better aligned with consumer demand.

For more information or to share your thoughts and opinions, contact the Business Management Center at 866.552.9193 or bmc@AgWestFC.com.

To receive email notifications about western and global agricultural and economic perspectives, trends, programs, events, webinars and articles, visit www.AgWestFC.com/subscribe or contact the Business Management Center.

Get access to the best crop hail insurance coverage and rates from multiple providers.

Learn more